Settlement Calculator

What Is a Settlement Calculator?

A Settlement Calculator (additionally referred to as a Loan Settlement Calculator) is an online financial tool that helps borrowers estimate how much money is needed to completely settle or close their existing loan.

It uses key statistics, which include:

- Outstanding Principal

- Annual Interest Rate

- Monthly Payment

- Loan Start Date

- Loan End Date

Based on those inputs, the tool calculates how an awful lot of your fee goes toward hobby and, foremost, providing you with a complete breakdown via an amortization schedule.

How Does the Settlement Calculator Work?

The working of the agreement calculator is easy yet powerful. Here’s how it calculates:

- You input mortgage information: principal, hobby charge, EMI, and period.

- It computes overall interest based on compounding frequency (monthly, every year, etc.).

- Shows amortization agenda: month-by-month division of principal and interest.

- Gives early settlement result: If you make greater payments, it indicates a new closure date and savings.

This makes it a must-have device for all and sundry who have taken a home mortgage, private loan, or automobile loan.

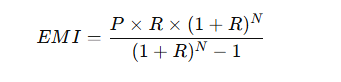

Formula Used in Settlement Calculator

The components for EMI (equated monthly installment) are

Where:

- P = Principal Loan Amount

- R = Monthly Interest Rate

- N = Number of Months

using anusing Once EMI is known, the remaining stability for every month may be calculated usingan amortization method, which allows the generation of the settlement schedule.

Benefits of Using the Settlement Calculator

- Plan Early Loan Closure

- It suggests how much you need to pay to close your mortgage in advance and how many hobbies you can store.

- Track EMI Payments

- Understand how your EMI is cut up into hobby and foremost.

- Budget Smarter

- You can plan your monthly budget better by way of knowing your actual outflow.

- Interest Comparison

- Helps you compare loans from exceptional banks and pick the maximum fee-powerful option.

- Transparency

- No need to rely on bank statements—get a clear, independent calculation.

Example of Loan Settlement Calculation

Let’s say:

- Outstanding Principal: ₹100,000

- Annual Interest Rate: 10%

- Monthly EMI: ₹10,000

- Duration: 11 months

When you input this info, the calculator shows:

| Month | Payment | Interest | Principal | Remaining |

|---|---|---|---|---|

| 1 | ₹10,000 | ₹833.33 | ₹9,166.67 | ₹90,833.33 |

| 2 | ₹10,000 | ₹756.94 | ₹9,243.06 | ₹81,590.27 |

| 3 | ₹10,000 | ₹679.92 | ₹9,320.08 | ₹72,270.19 |

| … | … | … | … | … |

| 11 | ₹10,000 | ₹41.75 | ₹9,958.25 | ₹0.00 |

This is the amortization schedule—it suggests how your balance reduces every month.

Early Loan Settlement Example

Suppose you start paying ₹2,000 extra each month as an additional price.

The calculator will right away display that your mortgage will end near 2 months earlier and you'll save around ₹3,000 in interest.

That’s the strength of a loan settlement calculator—you could virtually see how prepayments change your debt timeline.

Types of Settlement Calculators

- Loan Settlement Calculator—For home, vehicle, or personal loans.

- EMI Settlement Calculator—Focuses on EMI structure and balance.

- Loan Payoff Calculator—For locating when your loan can be fully repaid.

- Amortization Schedule Calculator—Gives month-wise breakdown.

- Early Loan Closure Calculator – Estimates savings from prepayment.

Why Use an Online Loan Settlement Calculator?

Because manual calculation takes hours—and one small mistake can alter your entire interest final results.

An online calculator gives you:

- Instant effects

- 100% accuracy

- Flexibility to test exclusive situations

- Free and smooth-to-use interface

So whether or not you are refinancing or just curious about your loan stability, this device is your private monetary assistant.

How to Use the Settlement Calculator (Step-by-Step Guide)

- Enter the outstanding principal—the amount you continue to owe to the financial institution.

- Fill in the Annual Interest Rate (%). Example: 8.5%.

- Enter Monthly EMI—your regular installment.

- Select Payment Frequency—Monthly, Quarterly, or Yearly.

- Choose Loan Dates—Start and End Dates.

- Click on “Calculate Settlement.”

The device will immediately display:

- Remaining balance

- Interest paid

- Principal paid

- Amortization table

You can even download or export the agenda as CSV for report maintenance.

FAQs About Settlement Calculator

Q.1. What is a loan agreement calculator?

It’s a web tool that helps you find the precise quantity needed to pay off your mortgage early or test EMI stability.

Q.2. Can I use it for personal or vehicle loans?

Yes. The calculator works for all varieties of loans—non-public, domestic, automobile, or schooling.

Q.3. Is it correct?

Yes. The device makes use of actual mathematical formulations utilized by banks to compute EMI and settlement amounts.

Q.4. Can I download my amortization agenda?

Yes, most calculators can help you export it in CSV or PDF format.

Q.5. What is the advantage of early settlement?

Early agreement helps you keep interest and turn out to be debt-free quicker.

Conclusion

A settlement calculator isn't only a tool—it's your smart economic accomplice.

It empowers you to take control of your loans, understand your payments, and store money with the aid of making knowledgeable selections.

Whether you’re planning early mortgage closure, evaluating EMI alternatives, or honestly monitoring bills, this calculator facilitates you living financially confident and debt-unfastened quicker.

Read More:-