How to Calculate YoY Growth: When it involves measuring commercial organization development, sales, or earnings through the years, one of the most dependable metrics is YoY growth—or year-over-year growth. It permits you to apprehend how your commercial employer has assessed the same length of the final 12 months.

📈 YoY Growth Calculator

What Is YoY Growth?

YoY increase (year-over-year increase) compares one length’s average performance to the identical length inside the previous 12 months. It’s commonly utilized in organization, finance, and advertising to measure development and dispose of the impact of seasonal modifications.

For example, if a business enterprise earned ₹1 crore in 2024 and ₹1.2 crore in 2025, then the YoY increase tells you how superbly the business grew in contrast to the final year.

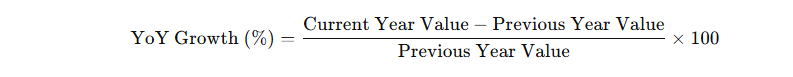

Formula to Calculate YoY Growth

The easy YoY growth approach is easy:

- Current Year Value: The statistics from the maximum modern 300 and 65 days (e.g., 2025 revenue).

- Previous Year Value: The records from the earlier year (e.g., 2024 sales).

- Result: Percentage growth or lower compared to the closing year.

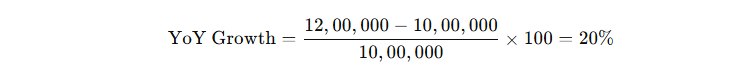

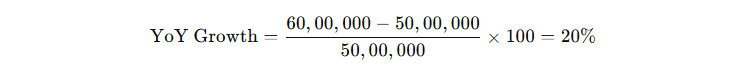

Example 1: Revenue YoY Growth Calculation

Suppose an organization’s sales statistics are:

- 2024 Revenue: ₹10,00,000

- 2025 Revenue: ₹12,00,000

Now, apply the components:

✅ Result: The employer’s sales grew by 20% YoY in 2025.

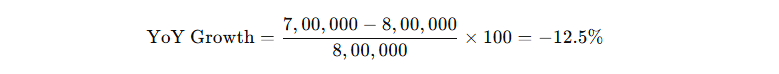

Example 2: Negative YoY Growth

Let’s take another instance in which normal performance declined.

- 2024 Profit: ₹8,00,000

- 2025 Profit: ₹7,00,000

Result: The organization experienced a 12.5% decline in comparison to the previous year.

Negative YoY growth isn't continually terrible—every so often it indicates an investment phase or seasonal slowdown.

Why YoY Growth Is Important for Businesses

Understanding the manner to calculate YoY increase is vital for multiple motives:

1. Tracks True Business Progress

It allows you to end up aware in case your enterprise organization is certainly developing or virtually fluctuating seasonally.

2. Eliminates Seasonal Impact

Unlike month-over-month comparisons, YoY eliminates seasonal biases along with vacations, galas, or one-time promotions.

3. Helps in Forecasting

With steady YoY facts, you may assume future growth trends and plan budgets correctly.

4. Investor Confidence

Investors depend closely on YoY growth to evaluate commercial enterprise corporation stability and potential earlier than making an investment.

5. Performance Benchmarking

Compare overall performance, no longer great, together with your personal past; however, moreover, with opposition in your corporation.

YoY Growth vs MoM (Month-over-Month) Growth

| Feature | YoY (Year-over-Year) | MoM (Month-over-Month) |

|---|---|---|

| Time Period | 12 months apart | Consecutive months |

| Use Case | Long-term performance | Short-term trend |

| Accuracy | More stable, seasonal effects removed | Can fluctuate |

| Best For | Annual analysis | Immediate campaign analysis |

✅ Tip: Use every metric together—MoM shows short-term adjustments, whilst YoY displays the long-term trend.

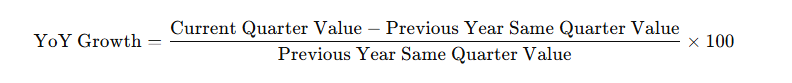

How to Calculate Quarterly YoY Growth

Sometimes you may need to calculate YoY boom for a selected area, like Q1 2025 vs. Q1 2024.

Use the identical gadget:

Example:

- Q1 2024 Revenue = ₹50,00,000

- Q1 2025 Revenue = ₹60,00,000

With that approach, your enterprise grew 20% in Q1 YoY, a nice indicator for a normal boom.

Real-Life Example: Company Growth Analysis

Imagine a small e-commerce organization, TrendKart, that wants to analyze performance over three years:

| Year | Revenue (₹) | YoY Growth |

|---|---|---|

| 2023 | 800,000 | — |

| 2024 | 1,000,000 | 25% |

| 2025 | 1,250,000 | 25% |

This suggests a regular 25% YoY boom—a healthy and sustainable style. Investors love such predictable booms, as they indicate stability.

How to Interpret YoY Growth Results

- 10–20% YoY boom: Good and sustainable.

- Above 25%: Strong organization performance.

- Negative boom: Needs hobby; study motives.

- 0% boom: Stable, however stagnant; don't forget new strategies.

Remember—YoY growth isn't always genuinely more than a few. It’s a mirrored image of business health, overall operational performance, and consumer retention.

YoY growth lets in groups throughout industries recognize what’s running and what desires development.

Advantages of Using YoY Growth Metric

- Clarity in Reporting: Simple to recognize and talk about.

- Trend Analysis: Shows long-time-period consistency.

- Decision Making: Helps allocate assets effectively.

- Motivates Teams: Measurable desires inspire better usual performance.

- Attracts Investors: Consistent growth = trustworthy company.

Limitations of YoY Growth

- Doesn’t replicate monthly fluctuations or short-term problems.

- External factors (inflation, marketplace slowdown) can skew consequences.

- Needs an accurate series of facts for reliability.

So while YoY increase is critical, it needs to be analyzed alongside one-of-a-kind metrics like quarterly growth, CAGR (Compound Annual Growth Rate), and income margins.

FAQs About How to Calculate YoY Growth

1. What does YoY increase imply in business?

It suggests how much of a fantastic deal an organization’s overall performance (sales, profits, or customers) has grown or declined as compared to the equal length of the very last year.

2. What is a splendid YoY boom charge?

Generally, a 10–20% YoY increase is taken into consideration as sturdy and sustainable for most companies.

3. How do I calculate YoY growth for multiple years?

Apply the equal components for each year and evaluate consequences in a table or chart.

4. Can YoY boom be poor?

Yes. Negative YoY means the modern-day duration was completed worse than the preceding year.

5. What’s the distinction between YoY and CAGR?

YoY compares 365 days to every different day at the same time, as CAGR calculates the not unusual annual boom fee over a couple of years.

Conclusion

Knowing the way to calculate YoY boom is vital for all of us running a business or managing monetary records. It’s one of the simplest, yet most effective, processes to recognize standard performance tendencies, grow to be aware of boom possibilities, and make smarter strategic decisions.

Read More:-