Stamp Duty and Registration Charges in Mumbai: Buying property in Mumbai is a dream for many, but understanding stamp duty and registration charges is crucial to avoid surprises during the transaction. This guide explains the current rates, how to calculate charges, and tips to save legally.

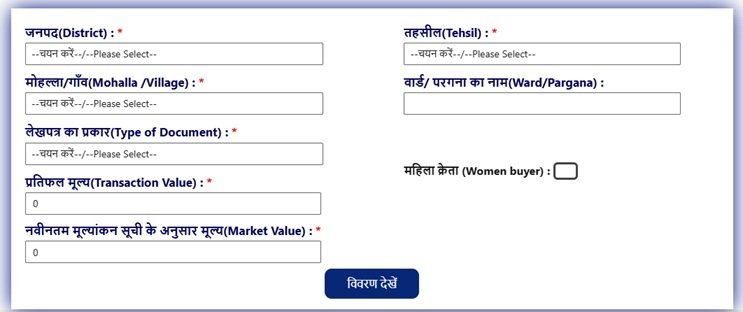

Registration Fee Calculator

What is stamp duty in Mumbai?

Stamp duty is a tax levied by the Maharashtra government on the transfer of property ownership. It is mandatory and calculated based on the market value or agreement value of the property, whichever is higher.

- Residential Property: 5% for women buyers, 6% for men (as of 2025)

- Commercial Property: 6–7% of property value

Stamp duty ensures that the property transaction is legally recognized, preventing disputes in the future.

Registration Charges in Mumbai—Explained

Apart from stamp duty, property buyers must pay registration charges, which cover the official registration of the property with the local municipal authority.

- Registration charges are generally 1% of the property value.

- Minimum charges in Mumbai are around ₹30,000–₹50,000, depending on property type and location.

Tip: Registration charges are fixed and do not depend on gender.

How to Calculate Stamp Duty and Registration Charges in Mumbai

Step 1: Determine the Property Value

Use the circle rate (government-assessed value) or agreement value (negotiated price), whichever is higher.

Step 2: Apply the Stamp Duty Rate

- Residential property: 5% (women) / 6% (men)

- Commercial property: 6–7%

Step 3: Add Registration Charges

- 1% of property value

- Ensure you meet the minimum registration charges applicable in Mumbai.

Example Calculation:

Property Value: ₹1 crore (residential, male buyer)

- Stamp Duty: 6% of 1 crore = ₹6,00,000

- Registration Charges: 1% of 1 crore = ₹1,00,000

- Total Cost: ₹7,00,000

Tips to Reduce Stamp Duty Charges Legally

- Women as Primary Buyers: Women buyers enjoy reduced stamp duty rates.

- Joint Ownership: Split property ownership with family members to reduce individual liability.

- Check Circle Rates: Compare circle rate with market value; sometimes underestimating legally can save costs.

- Use Online Payment: Paying online often gives discounts or cashback in some areas.

Online Payment of Stamp Duty and Registration

Mumbai property transactions can now be done partially online:

- Visit the Maharashtra Government Property Registration Portal.

- Fill in property details, property value, and buyer details.

- Pay stamp duty and registration charges via online banking.

- Collect receipts for legal records.

Internal Linking Suggestions:

- Link to your Property Calculator page for quick stamp duty calculation.

- Link to guides like “Property Buying Process in Mumbai” or “Land Valuation in Maharashtra.”

Frequently Asked Questions

Q.1: What is the current stamp duty rate in Mumbai?

Ans: For residential property, it is 5% for women buyers and 6% for men. Commercial property rates range between 6 and 7%.

Q.2: How are registration charges calculated?

Ans: Registration charges are generally 1% of the property value, with a minimum fixed amount depending on the property.

Q.3: Can I reduce stamp duty charges legally?

Ans: Yes, by using women as primary buyers, joint ownership, or carefully checking circle rates.

Q.4: Is online payment accepted for stamp duty?

Ans: Yes, the Maharashtra government portal allows online payment for both stamp duty and registration charges.

Q.5: Does stamp duty differ for residential and commercial properties?

Ans: Yes, residential properties have slightly lower stamp duty compared to commercial properties.

Conclusion

Understanding stamp duty and registration charges in Mumbai is crucial for every property buyer. By calculating correctly and following legal tips, you can save money and ensure a smooth property transaction.

Disclaimer:

The information provided in this article is for general informational purposes only. While we strive to keep the content accurate and up-to-date, stamp duty and registration charges may vary based on government regulations, property type, and location. We recommend consulting with legal professionals or the Maharashtra government property registration portal before making any property transactions. The website or author is not responsible for any financial or legal consequences arising from the use of this information.

Read More:-

- Class Grade Calculator—Calculate Your Grades Instantly

- Which Country Invented the Googly Ball? | History, Inventor & Facts

- Hindi Shayari for Love in Hindi – प्यार के लिए बेहतरीन हिंदी शायरी

- Washington Payroll Calculator | Estimate Taxes & Take-Home Pay

- Bhulekh Gujarat: Online Land Record, Map, and Khatauni Check